Spearheading Europe's Influence on Financial Reporting: A Review of EFRAG FR's 2024 Activities

By Wolf Klinz, EFRAG FRB Chair

EFRAG’s Financial Reporting Pillar (FR) has the mission of helping to implement new or amended global reporting standards. At the same time, it must ensure that European views are taken into account in this process and thus adequately defend the interests of the European business community.

To meet its objectives, FR works in three ways.

It reacts to exposure drafts or discussion papers on new or amended standards proposed by the IASB in London.

It conducts its own research work and develops ideas for introducing new standards or improving existing ones, partly based on input from European stakeholders and constituents.

It advises the European Commission on the endorsement of new or amended standards.

IFRS 18 Presentation and Disclosure in Financial Statements:

It introduced three new reporting categories, operating, investing and financing, as well as Management Performance Measures (MPM). The improved presentation of financial information will make accounts more transparent and comparable. The endorsement process is expected to start in May 2025. Implementation is foreseen as of 1 January 2027.

IFRS 19 Subsidiaries without Public Accountability: Disclosures

Amendments to this standard for subsidiaries without public accountability will ease the financial reporting of eligible subsidiaries, reducing the cost and burden for preparers while meeting the needs of users of their financial statements. Implementation is foreseen as of 1 January 2027.

IAS 28 Investments in Associates and Joint Ventures

The IASB does not currently intend to fundamentally revise the equity method but rather focus on reducing diversity in its application. A final comment letter has been issued by FR for comments from constituents.

IAS 37 Provisions – targeted improvements

Rather than fundamentally revising the standard, the IASB recommends improvements in three areas: clarifying current requirements, reducing diversity and changing the timing of recognition.

IFRS 9 Financial Instruments

FR contributed to the IASB’s amendments to accommodate Power Purchase Agreements (PPAs). The amendments address how PPAs for renewable energy should apply the own-use exception in IFRS 9 for physical PPAs or apply hedge accounting for virtual PPAs.

Future Standard for Accounting for Regulatory Assets and Regulatory Liabilities

EFRAG discussed intensively with European Transmission Systems Operators (TSOs) to speed up the development of the future IFRS Standard on rate-regulated activities, allowing operators to fairly present their performance and thus secure affordable funding for major infrastructure investments. The preparatory endorsement work, survey and field testing will take place in H1 2025, with the draft endorsement advice taking place in the second half of 2025.

IFRS 7 Financial Instruments: Disclosures

Given the volatility of the interest development in capital markets, dynamic risk management of interest levels is gaining importance, particularly in the financial services sector (with banking at first and insurance probably at a later stage). FR prepared a draft comment letter and will follow the project closely.

_________________________________________________________

EFRAG published a discussion paper on the Statement of Cash Flows in November 2024. The underlying ideas and objectives were presented at the European Accounting Association (EAA) congress in Bucharest in May 2024 and at the IFASS conference in London in September. The IASB has included the project in its work plan.

EFRAG intends to bring the reporting of the FR and SR pillars more closely together. The Connectivity project is under the remit of FR. As an interim deliverable, an initial paper was published in June 2024, and outreach on it was done thereafter. A Discussion Paper will be released in 2025.

FR considers 2024 to have been a very positive year. Many projects were finalised or advanced considerably. FR made a valuable contribution to improving financial reporting, enhancing transparency for users, reducing costs and burden for preparers, and bringing FR and SR more closely together, thus contributing to the European public good.

Thought Leadership:

EFRAG’s Proactive Research Work

Identifying the Gaps: EFRAG's Analysis of the Statement of Cash Flows

The requirements on how to prepare the statement of cash flows mainly date back to the early 1990s. As a result, they do not take into account new types of transactions (e.g. supplier finance transactions), manners to manage cash and new types of payments (e.g. digital currencies). Users of financial statements have thus called for an update of the requirements.

As fixing an issue first requires identifying all the problems, EFRAG initiated a project to identify the main issues with the statement of cash flows. EFRAG observed that the perceived issues with the statement depend on how the statement is used. Accordingly, EFRAG also examined the objectives and usages of the statement and linked them to the identified issues. Input was collected from literature, interviews and outreach. In November 2024, EFRAG published the discussion paper The Statement of Cash Flows—Objectives, Usages and Issues to receive further input on the topics considered.

EFRAG’s discussion paper, and the responses that it will receive on it, will be used to provide timely and comprehensive European input to the IASB’s project on the revision of the requirements for the statement of cash flows, which started in September 2024.

Steady Progress in EFRAG’s Connectivity Project

Both European and global stakeholders have called for increased connectivity of information across different reports to enhance coherence of information within and among them and ensure that reporting is a strategically oriented communication exercise. Yet, connectivity, which has connotations of connections, consistency and coherence of information in different reports, is not effectively reflected in many of them. This could be because there are no explicit requirements for connectivity under IFRS Accounting Standards, and such requirements have only been introduced into mandatory sustainability reporting requirements (ESRS and ISSB Standards).

In June 2024, as part of EFRAG’s ongoing connectivity research project, and drawing on insights provided by the EFRAG Connectivity Advisory Panel (CAP), EFRAG published the paper ‘Connectivity Considerations and Boundaries of Different Annual Report Sections’ (EFRAG Connectivity project initial paper). The paper is an interim deliverable preceding the publication of a Discussion Paper, which will also include illustrations of connectivity. It laid out the conceptual foundations as well as different aspects and techniques of connectivity.

It also conceptualised the factors influencing reporting boundaries (i.e. what information is included or excluded across different reports, including the financial statements) and pointed to several areas where there are mixed views on the optimal location of reported information (e.g. climate-related commitments, unrecognised intangibles and synergies from M&A transactions). Finally, the initial paper suggested steps to either clarify boundaries or enhance connectivity, including leveraging XBRL-tagged technology, developing a sustainability reporting conceptual framework and providing enhanced management commentary guidance.

In the second half of 2024, EFRAG conducted outreach on the initial paper and gathered insights from EU and global stakeholders, which will enhance the practical illustrations of connectivity being developed in collaboration with the EFRAG CAP for inclusion in EFRAG’s Discussion Paper. The outreach also confirmed the importance of ongoing engagement with stakeholders due to evolving practical experiences in applying connectivity principles.

In 2025, EFRAG will conduct outreach with stakeholders on the suitability of its gathered practical illustrations of connectivity and the issues faced in implementing connectivity. The feedback received will be incorporated into the Discussion Paper, which will be published thereafter.

Influencing the IASB and Standard-Setting Activities:

EFRAG’s Reactive Work

Proposed Amendments to the Equity Method: A Step Far Enough?

The equity method of accounting, as outlined in IAS 28 Investments in Associates and Joint Ventures, applies to an investor/company with significant influence but no control over an investee (i.e. when an investor/company has 20% or more of ownership interests). For several years, stakeholders from the EU and other jurisdictions have called for the IASB to either clarify, update or reconsider the purpose of the equity method of accounting, as demonstrated through feedback to the 2011 IASB agenda consultation and via several clarification requests submitted to the IFRS Interpretations Committee. This call arose due to the complexity and gaps in IAS 28 requirements as well as questions on the usefulness of related reported information.

Responding to stakeholders’ calls, the IASB decided not to undertake a fundamental review but to focus instead on developing answers to application questions to reduce diversity in preparers’ reporting practices and improve the understandability and comparability of reported information. This was achieved through an Exposure Draft (ED) that was open for comments until January 2025.

In response, EFRAG published draft and final comment letters in November 2024 and January 2025. Overall, EFRAG agreed with several of the ED’s proposals, including the measurement of cost of an associate or joint venture and the recognition of full gains or losses for transactions with associates and joint ventures. In parallel, among its several recommendations, EFRAG also called for further simplification of the proposals for step acquisitions of ownership interests in an investee and the development of a holistic, principle-based solution for non-exchange changes in ownership interests.

Due to lingering questions and mixed views on the purpose and usefulness of the equity method, EFRAG has suggested that the forthcoming IASB agenda consultation seek constituents’ views on whether a fundamental review of this accounting approach is needed. Going forward, EFRAG will monitor the IASB’s redeliberations on the feedback received and decisions made on the project direction.

Goodwill and Acquisition Transparency: EFRAG's Assessment of IASB's Business Combinations Project

The Post-implementation Review of IFRS 3 Business Combinations showed, among other things, that investors were not satisfied with the usefulness of the information provided by the current requirements. Accordingly, the IASB initiated a project to improve the accounting and disclosures of business combinations by exploring whether companies can, at a reasonable cost, provide investors with more useful information about the business combinations those companies make.

Following the IASB’s discussion paper issued in 2020, on which EFRAG held intensive consultations with constituents, the IASB published the Exposure Draft Business Combinations—Disclosures, Goodwill and Impairment (‘the ED’) in March 2024. The ED proposes amendments to improve disclosures on the performance of business combinations and the impairment test of cash-generating units containing goodwill.

Following the publication of the ED, EFRAG launched another consultation with constituents by publishing its draft comment letter (‘the DCL’) in April 2024. In the DCL, EFRAG expressed significant concerns about the costs and commercial sensitivity of the proposed disclosures and listed some issues with the proposals related to the impairment test.

Feedback received from constituents in response to the DCL confirmed EFRAG’s initial concerns, which were subsequently reflected in EFRAG’s final comment letter published in July 2024. In particular, although agreeing with the project’s objective of improving information for investors at a reasonable cost about acquisitions made, EFRAG expressed key reservations about some of the proposed amendments to disclosure requirements. Furthermore, EFRAG was not convinced that the proposed improvements to the impairment test would change existing practice, and hence, the project’s objective would not be met. As a result, EFRAG provided a number of suggestions for the above amendments.

In 2025, the IASB started its redeliberations on the project by analysing the feedback received. EFRAG will closely monitor these redeliberations.

Back to Menu

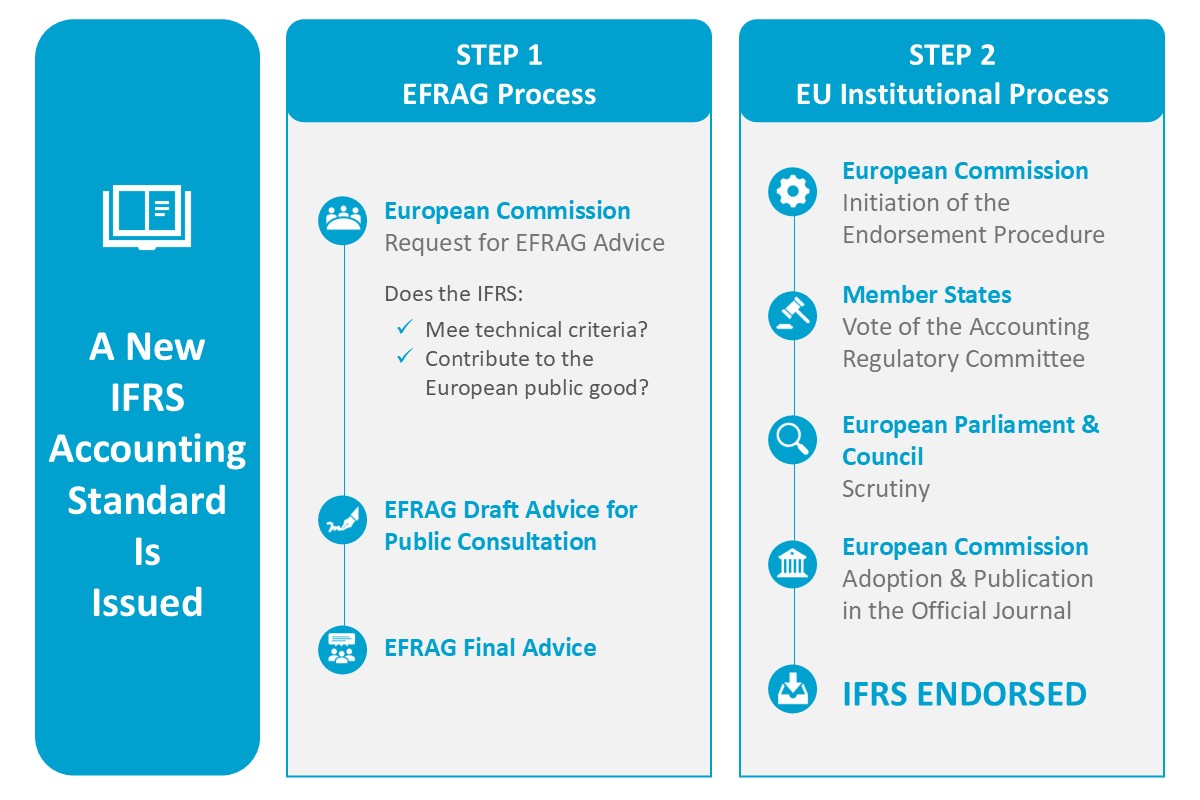

Ensuring IFRS Accounting Standards Are Fit for Use in Europe:

EFRAG’s Endorsement Advice

The IFRS Accounting Standards endorsed in the course of 2024, along with their effective dates of application in the EU and the dates of endorsement and publication in the Official Journal, are set out in the table below.

IFRS 18: EFRAG's Endorsement Advice and the Path to Improved Financial Reporting in Europe

IFRS 18 Presentation and Disclosure in Financial Statements is a long-awaited standard that impacts the reporting requirements for each entity and replaces IAS 1. The standard primarily aims to improve how companies communicate in their financial statements. IFRS 18 sets out general and specific requirements for the presentation of information in the primary financial statements and the disclosure of information in the notes.

IFRS 18 was published on 9 April 2024 following extensive consultation with different types of stakeholders, including from Europe (organised by EFRAG). The improvements introduced by IFRS 18 focus on the income statement, addressing investor demands for increased comparability, transparency, and consistency in how companies communicate their performance. The term operating profit or loss is now clearly defined. Investors have also called for transparency in the use and calculation of non-IFRS measures, as well as for improved grouping of information in the financial statements.

During the consultation phase, EFRAG tried to influence the IASB in finding an approach that balances investors' needs with the costs for preparers. EFRAG had already prepared for the endorsement process ahead of the standard's publication, in order to support its early application in Europe.

As part of its stakeholder engagement activities to inform its draft endorsement advice, EFRAG, together with the IASB and some of its member organisations, held educational sessions dedicated to corporates (on 7 June 2024) and financial institutions, including insurance companies and conglomerates (on 11 June 2024).

On 15 November 2024, after extensive outreach on the standard's impact, EFRAG published its Draft Endorsement Advice on IFRS 18 Presentation and Disclosure in Financial Statements. EFRAG’s preliminary conclusion is that IFRS 18 satisfies the criteria for endorsement for use in the EU and therefore recommends IFRS 18 for its endorsement. EFRAG partly expects significant implementation costs depending on the business model. However, ongoing costs are assessed to be relatively low.

EFRAG plans to publish its Final Endorsement Advice in Q2 2025, which will support the finalisation of the European endorsement process for the important standard before the end of 2025. Finalising it a year or more ahead of the required application date will allow preparers sufficient time for implementation.

Towards Simplified Reporting: EFRAG's Work on Endorsing IFRS 19 for European Subsidiaries

IFRS 19 Subsidiaries without Public Accountability aims to improve the effectiveness of disclosures in financial statements by allowing eligible subsidiaries to apply IFRS Accounting Standards with reduced disclosures. This reduced-disclosure standard responds to feedback from global preparers to simplify the financial reporting burden for their subsidiaries, for which the IFRS disclosure requirements were often disproportionate to the needs of their users.

Considering the importance of the potential burden reduction for eligible European entities, EFRAG has conducted extensive consultations with its constituents and published various educational materials, as well as other supporting documents, to aid the endorsement of the standard in the EU. The aim was to balance the reduction in disclosure requirements—and the resulting cost savings for preparers in Europe—with the information needs of users of the financial statements of eligible subsidiaries.

Two EFRAG Secretariat Briefings, ‘An EU Perspective on the Scope of IFRS 19’ and ‘Study on Compatibility of the EU Accounting Directive with IFRS 19’, were published in 2022 and updated in 2024. In December 2024, EFRAG organised a joint EFRAG–IASB educational event to discuss the applicability of IFRS 19 in the European Union and the EU endorsement process. Additionally, to address specific requests outlined in the endorsement advice request from the European Commission, which EFRAG received in September 2024, two surveys targeting preparers and users were published in December 2024 to gather the views of European constituents on the costs and benefits of the voluntary application of the reduced-disclosure standard in the EU.

In 2025, EFRAG will analyse the feedback received from its constituents during the endorsement phase and assess the endorsement criteria. It expects to publish its Draft Endorsement Advice letter to the European Commission for public consultation in Q2 2025, and its Final Endorsement Advice in Q3 2025. This timeline is intended to ensure the endorsement of the standard before the voluntary first-time application date of 1 January 2027 and to provide preparers with sufficient time for implementation.

Reporting the Financial Impact of Power Purchase Agreements: IASB's New Rules and EFRAG's Fast-Track EU Support

In the second half of December 2024, the IASB issued amendments to help companies more effectively report the financial effects of nature-dependent electricity contracts, which are often structured as power purchase agreements (PPAs).

Targeted amendments to IFRS 9 Financial Instruments and IFRS 7 Financial Instruments: Disclosures include clarifying the application of the ‘own use’ requirements, simplifying the designation of such contracts as hedging instruments, and introducing new disclosure requirements to help investors better understand the impact of these contracts on a company’s financial performance and cash flows.

The publication of the amendments marks the conclusion of a fast-paced project to which EFRAG made a significant contribution throughout 2024, including the publication of its Draft and Final Comment Letters (in June and July, respectively).

On 18 December 2024, EFRAG received a request for endorsement advice from the European Commission. EFRAG published its Draft Endorsement Advice on 23 December 2024 and its Final Endorsement Advice on 16 January 2025.